WHAT IS THE TAX NORM 347 AND WHAT IS IT FOR?

Focusing on model 34, here is a brief explanation of what it is and how it works:

Once again this year it is time to present the 347 tax form to the tax authorities. 28 February is the deadline set by the Tax Agency for presenting one of the annual forms that causes the most doubts and surprises for organisations. This form provides the necessary information to the Inland Revenue about the operations with third parties that the taxpayer has carried out, and all this information is not only within Dynamics NAV or Business Central, but the standard has a tool that helps you to extract it. The use of this module of the standard is not always simple, given that the system is fed with the information that we have been processing throughout the year, it is relatively common that it does not match the reality, as any small user error can affect the result. That is why Dynasoft has developed the Dynasoft Advanced Fiscal Management product, which includes tax forms for different types of taxes, such as VAT (forms 303,347,349,390), Personal Income Tax (forms 111,115,123,180,190,193) or corporation tax (forms 216,232,296,200,202,840).

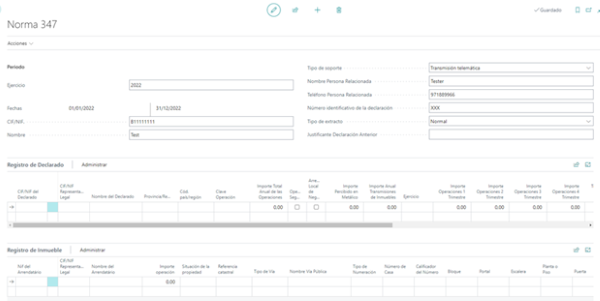

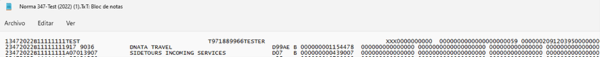

Firstly, the Standard 347 functionality is a Dynasoft improvement on the standard Business Central 347 model. The main difference is that Standard 347 includes a preview of the information to be exported in a txt format file, so that we can edit it before submitting it to the AEAT website.

Both last year and this year the Microsoft standard is not working properly, when correctly exporting the information to a .txt file and uploading it to the AEAT website it gives an error due to differences in format. This is because there are discrepancies between what the AEAT requires in the file and the documentation that the public body presents to the manufacturers. Our module resolves this error and allows you to edit the file to resolve these small errors.

What are the steps to follow: first of all, fill in the fields Fiscal year, VAT number, name, name of related person, related person's name, related person's telephone number, identification number of the return and proof of the previous return. To do this, go to "Actionsà Calculate" so that the system brings us the data to be included in the txt file.

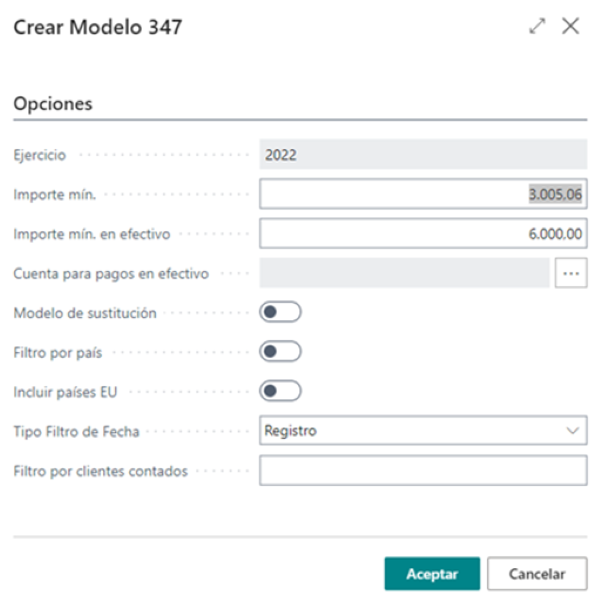

Prior to the calculation, we can apply some filters. By default, the system filters by Minimum Amount (3.0005,06) and minimum amount in cash (6.000).

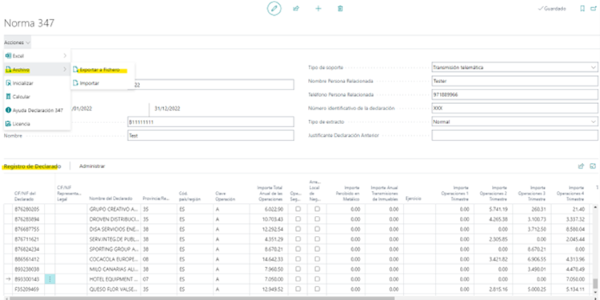

When executing the Calculate functionality, the required information will appear in the secondary table Declared Record. Here we can check and/or modify this information.

Finally, from ActionsàFileà Export to File we will export the previous data to a TXT file.

Share